Miscellaneous

Electric Panel Upgrades

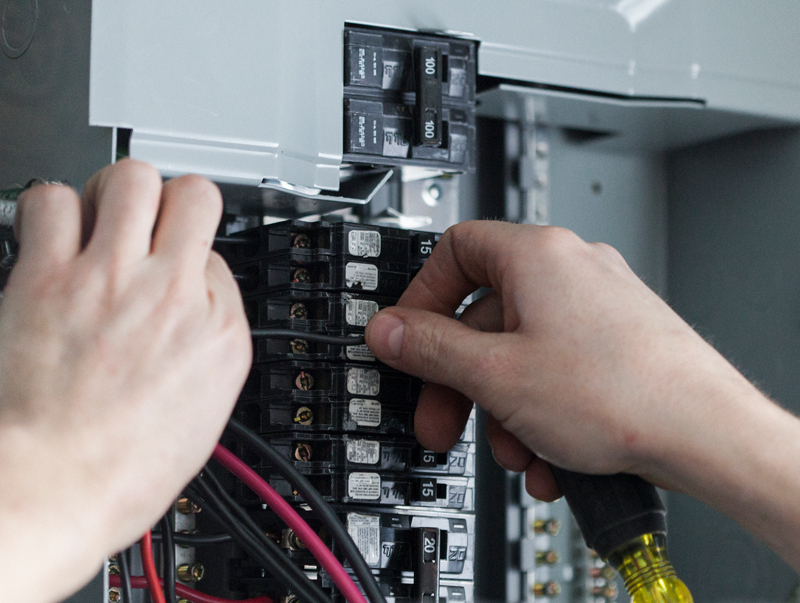

How They Work

Electric panels control the flow of electricity to different parts of a home. Each connection on the panel has a circuit breaker that can stop the flow of current to specific circuits and appliances. The accelerating electrification of America is leading to many residential technologies historically fueled by natural gas, such as water and space heating, to become electrified. This has and will continue to lead to the need to update home electric panels as home electric loads increase to allow for the addition new electric technologies, such as electric water heaters, heat pumps and electric vehicle charging systems. Electric panels in homes built before 1980 are outdated and in need upgrades. Even homes built after 1980 may have panels needing upgrades to handle future growth of electric technologies in the home.

What Assistance Is Available for Me?

There are several sources of funding to assist you with an electric panel upgrade:

- The federal government offers a tax credit of up to 30% of the cost an electric panel upgrade (maximum $600 credit) if it’s upgraded in combination with another upgrader. Find more information about federal tax credits for electric panel upgrades here.

What Products Are Eligible?

To be eligible for the federal tax credit, electric panel upgrade must:

- Be installed in a manner consistent with the National Electric Code,

- Have a load capacity of not less than 200 amps,

- Be installed in conjunction with, and enable the installation and use of:

- Any qualified energy efficiency improvements, or

- Any qualified energy property (heat pump water heater, heat pump, central air conditioner, water heater, furnace or hot water boiler, biomass stove or boiler).

Important Dates

The federal tax credits are available for products purchased and installed between January 1, 2023, and December 31, 2032.